At least 1.9 MILLION foreign nationals claiming benefits in Britain

New data from the ONS and DWP shows scale of the crisis facing Britain

New research by the Centre for Migration Control (CMC) reveals that there are at least 1.9m foreign nationals claiming benefits in the United Kingdom.

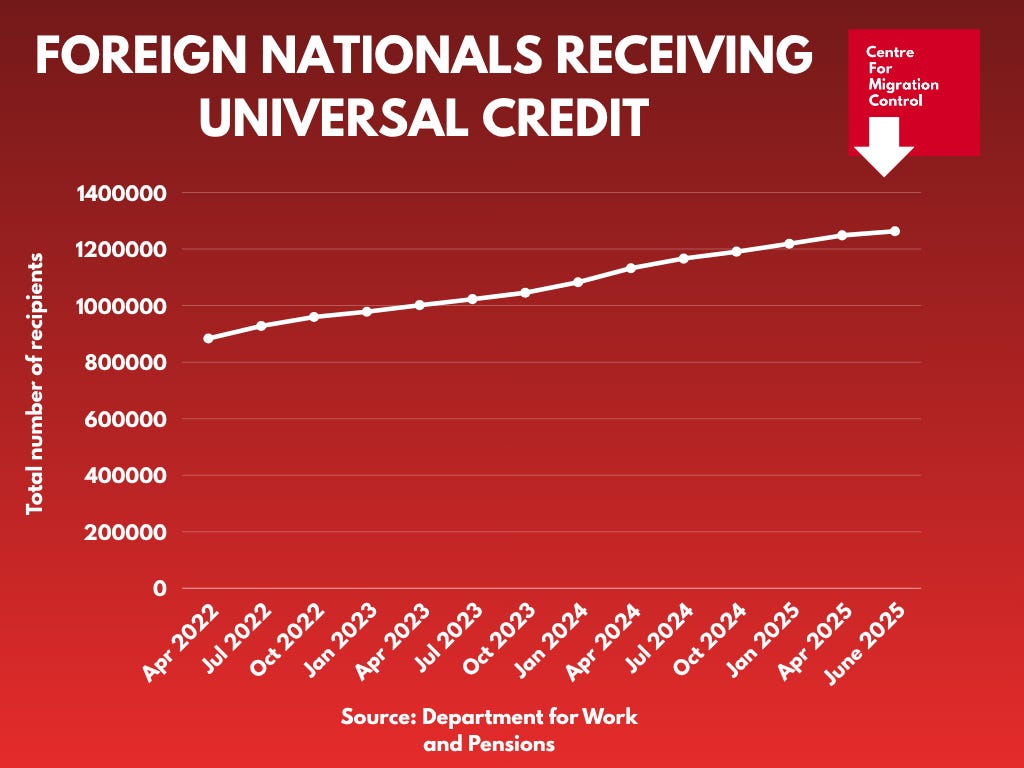

In July, the DWP finally published data on the number of foreign nationals claiming Universal Credit.

It was revealed that, in June 2025, there were 1.26m foreign nationals claiming Universal Credit, having risen from 883,000 in 2022.

More recently, the Telegraph revealed that foreign nationals received £10.1bn in Universal Credit payments in 2024.

This figure looks set to balloon further in 2025, as foreign nationals received £941m in March 2025 alone, up from £726m just twelve months earlier.

Between March 2022 and March 2025, the UK spent £24.79bn on Universal Credit payments to households containing non-UK/Irish nationals.

Universal Credit represents just one type of benefit that eligible foreign nationals are able to claim, yet the DWP has so far refused to publish data on other benefit types, such as PIP, housing benefit and child allowance.

Data obtained by the CMC from the ONS shows that hundreds of thousands of foreign nationals are claiming other benefit types than Universal Credit.

The Labour Force Survey conducted between April and June 2025 shows that there were 623,377 foreign nationals claiming a benefit, or combination of benefits, that did not include Universal Credit.

This includes 474,321 just claiming child allowance, 69,561 just claiming pension benefits, 70,788 just claiming sickness/disability benefits, 15,891 just claiming housing benefit, and 10,558 claiming both housing benefit and child allowance.

This would mean that in June 2025 there were at least 1.88m foreign nationals receiving benefits from the British state.

In total there were 383,011 EU nationals claiming a non-UC benefit combination and 240,366 non-EU nationals claiming a non-UC benefit combination.

However, the Labour Force Survey is known to under-report the number of benefit claimants. This was confirmed by the ONS who told the CMC that “under-reporting of benefits in surveys is a known issue”.

A recent DWP review into the family resources survey also found that “estimates have consistently undercounted actual benefit and tax credit caseloads over time”.

This would mean that the number of foreign nationals claiming a non-UC benefit is likely much higher.

To try and ascertain the rate of underreporting, the CMC compared the number of foreign nationals Universal Credit claimants recorded by the LFS with official DWP data.

As noted above, the DWP records that in June 2025 there were 1.26m foreign nationals receiving Universal Credit, yet the LFS records just 657,219.

This means that the LFS underreports the number of foreign nationals claiming UC by 91.7%.

Were a similar underreporting to have taken place with foreign nationals claiming non-UC benefits, the figure would increase from 623,377 to 1.19m.

The potential conclusion to be drawn from this is that there are up to 2.45m foreign nationals claiming both Universal Credit and non-Universal Credit benefits.

Universal Credit combinations

Overall, the LFS reports that, including those on UC, there are nearly 123,000 foreign nationals in receipt of housing benefit, 158,000 in receipt of sickness or disability benefit, and a staggering 811,000 in receipt of child allowance.

It suggests that, of those foreign nationals claiming Universal Credit, 40% are claiming no other benefit type in tandem.

A further 36% are claiming Universal Credit in tandem with child allowance, 7.7% are claiming Universal Credit along with disability or sickness benefits, 5% along with both housing benefit and child allowance, and 3% along with both child allowance and sickness or disability benefits.

Estimates released earlier this month by the Office for National Statistics suggest that there were around 8m foreign nationals living in the United Kingdom in 2024. This would mean that a quarter of foreign nationals living in the UK are on some form of welfare support from the British state.

Of course, many foreign nationals living in Britain are not yet eligible to claim benefits as they have no recourse to public funds (NRPF).

Estimates by the Centre for Policy Studies suggest that of those millions of foreign nationals who arrived under the last Conservative government, and the so-called ‘BorisWave’, 800,000 will ultimately go on to receive Indefinite Leave to Remain (ILR).

Oxford’s Migration Observatory has suggested that at the end of 2024 there were 430,000 foreign nationals living in the UK with ILR. Shockingly, DWP data shows that in May 2025 there were 208,251 people with this status who were claiming Universal Credit - a staggering proportion of the total number with this status.

The LFS itself reveals interesting data on the routes that foreign national benefit claimants used to arrive in the UK.

35% (663,000) of all benefit claims were made by foreign nationals who had arrived in the UK to work.

9.4% (179,500) of all claims were made by foreign nationals who had arrived in the UK to study.

30% (580,000) of all claims were made by foreign nationals who had arrived in the UK as a dependant or family member. Nearly two thirds of these claims (61%) were made by non-EU nationals.

7.5% (144,000) of all claims were made by foreign nationals who had arrived in the UK as someone seeking asylum.

Noting the massive underestimate it has made of UC claimants, the data from the LFS is nonetheless startling in and of itself.

It suggests there were 1,897m active benefit claims made by foreign nationals between April and June 2025, new research by the Centre for Migration Control can reveal.

54% of those claims were made by EU nationals (1,027,000) and 46% by non-EU nationals (869,000).

A further 1,479m claims were made by foreign born individuals who now held British citizenship.

This means, in total, there were 3,376m benefit claims being made by individuals who were born outside of the UK.

Cut those benefits and we have a balanced budget without tax increases.

The answer for how we unf**k our country is staring right in front of us. Cut the benefits overnight and let the rats come out of their hiding place - they'll scramble back to their third world slum countries once they realise the game is up.

The question is which political figure has the balls to the pull the plug. If needs be, mobilise the army on the streets to see the Islamic rats out of this country as no doubt they'll be looking for revenge.